Soft Landing or Crash? - June Real Estate Market Report

Tuesday Jul 12th, 2022

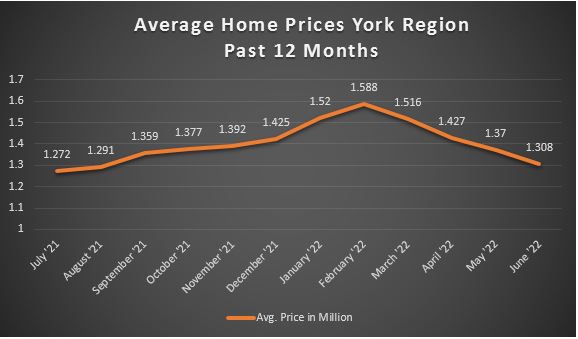

Higher borrowing costs continued to impact sales and home prices in June. The average price for a home in York Region was down to $1.308 million and prices are now back to where they were in late last summer. We are awaiting tomorrow's Bank of Canada Interest Rate Announcement with anticipation and some unease.

(Source TRREB Market Watch)

Aurora balancing, East Gwillimbury dropping

The average price for a home in Aurora in June was $1,461,741 - similar to May but 10.5% lower since the peak in February. On a year-over-year basis prices in Aurora are still up 15.2%. However, one of the 71 homes that have sold last month was 53 Steeplechase which sold for $7,350,000. A sale like this impacts the average notably in a small sample.

In Newmarket prices have dropped 21% since February. A home costs now $1,143,875 on average. That is slightly more than 12 months ago ($1,088,667) and 4% less than in May. In East Gwillimbury prices are already 5.7% lower than last year (June '21: $1,331,763 / June '22: $1,255,788).

GTA: Sales 41% down

Throughout Toronto and the GTA, 6474 Sales were reported on the Real Estate Board's MLS System. That's 41% less than last year. The average price for all homes combined of $1,146,254 is slightly higher (+5.3%) than 12 months ago.

What we're seeing is the 4th month in a row where prices have plummeted. Will the market balance out or will we see a further decline? The Bank of Canada's announcement will have an impact on that, we would assume.

Post a comment