Looming Tariffs slow down Sales - February Real Estate Market Update

Wednesday Mar 12th, 2025

After a brief uptick at the end of January, the Real Estate Market slowed down again in February. Buyers have become less confident in the economy, and uncertainty about our trade relationship with the United States has likely prompted some households to adopt a wait-and-see approach to purchasing a home.

Home sales on the Toronto Real Estate Board last month were down 27% compared to the same period last year, while listing inventory remained high. Active listings increased by 76%.

-Newmarket Holding Strong

rices in Newmarket ($1,185,427) have decreased by 3.7% compared to last year but have risen significantly (+12%) from the previous month. The number of homes sold (63) was almost double that of January (35).

The average price in Aurora, where 31 homes were sold, was $1,147,807, reflecting a 21% decrease compared to last year.

-Sales Up in East Gwillimbury

More transactions were reported in East Gwillimbury (43 sales) compared to last year (35).

The average price in EG was $1,277,279 (-3.2%).

Similarly, prices in Bradford (average $1,026,110) declined by 7.2%.

-A delayed Spring Market?

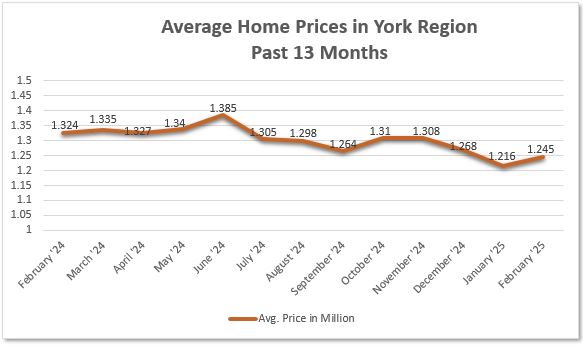

The average price in York Region for all home types combined was $1,245,087, which is slightly higher (+2.4%) than in January but down 6% year-over-year. It is worth noting that February 2024 was one of the best months for selling a home last year.

With looming tariffs, a prolonged winter, and ample inventory, it is no surprise that the real estate market has yet to gain significant traction.

With the Bank of Canada’s rate drop (Overnight Rate) of 0.25% on Wednesday and warmer weather on the horizon, we anticipate the market to pick up within the next 2–4 weeks.

The next Rate Announcement will be on April 16.

Post a comment